Firstly we have to understand some key facts about the Russian economy.

- It is not a normal economy.

- Even thought it is not a normal economy, the economic rules that influence normal economies still have the same basic effects, because those are based on the fundamental rules of supply and demand.

- Everything you do has an effect when you tweak any aspect of any type of economy.

- There are always unintended consequences you didn’t account for.

THE NEW RUBLE REALITY

The Russian currency has appreciated in value by some 25% in value, which many would claim is a good sign for the economy. Usually this indicates that foreign buyers want to trade with you so they buy your currency and as always if there is demand, prices rise.

In this case this is not true. The fact is that the government tries to make the currency look better than it actually is, and the market for Russian rubles is in fact so small, that the Central Bank has been buying up its own currency again to make it look attractive – the currency is not, in market terms, ‘floating’ and subject to the ravages of the international market. It is in a closed loop controlled by the central bank and its valuation has been artificially created. In effect the ruble is now divorced from the real economy and its valuation is not affected by it.

Oddly enough you might think this is a good thing for Russia – it cheaply re-valued the currency and saved itself from a currency collapse. In fact its had seriously detrimental effects which we’ll look at later.

STRONG RUBLE = CHEAPER IMPORTS = REDUCED INFLATION?

This would be the case if the ruble was free floating currency or not, technically if you import something at 113 to the USD and its now costing only 85 to the USD, you should be seeing lower prices. So why isn’t that happening?

The reason is simple enough, nobody wants to trade in rubles because of a mix of sanctions and volatility. India and China insist on using UAE Dirhams in India’s case because the Russians don’t want Indian Rupees, and Chinese Yuan because China doesn’t want Russian rubles it can’t buy anything with. Most illegal trade is done in US dollars or Euros when sanctions busting so as long as Russia can find a way of acquiring those (which it can do using gold of which it has ample supplies, traded through middle eastern markets), it can sustain the illegal markets which while they exist, are not so vast as to require more than Russia can afford.

Generally speaking illicit goods remain expensive by their very nature, and because nobody buys or sells in rubles it has no impact on the cost of real goods in the shops or resources for industry, so no price reductions and no cut in inflation.

WAGES GROWTH IS TOO HIGH

The scale of wages growth continues to outpace any normal economy because official inflation doesn’t take into account real inflation on food & fuel which averages some 35% on the former. The chronic labor shortage caused by high demands for skilled workers (many of whom flit between jobs across several employers as they sell their services), and then worsened by siphoning so many men into the army from where around 33% never return, has a pay growth rate above 11% per month and rising steeply. That is not going to reduce inflationary pressures any time soon. Inflation has still been rising and stands officially at 10.1%, but we know in reality it is far higher. Despite the high pay growth ordinary Russians are not really better off because real inflation undermines their buying power.

EXPORTS

If you were selling a £1 dollar item and it was sold at 113 rubles to $1 you obviously get 113 rubles back. This is good for you if you are exporting Russian goods and services. However, if you are still selling an item at $1 now you’re only getting just under 85 rubles back. Not such a good return, indeed 25% less and a major loss of income.

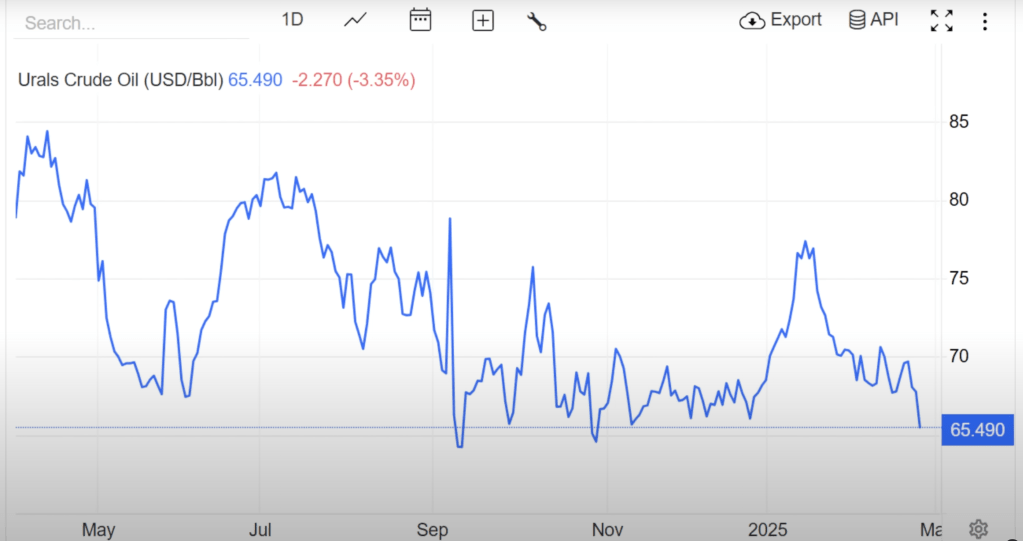

But Russia exports very little anyone much cares about except commodities and the most important of those is its crude oil . That is now trading at almost half what it was in early 2022, and has fallen $20 per barrel since May last year, trading at just short of $65.50 now and its on a downward trend.

Now there is no longer a direct link between the ruble and the oil price, but there is a nasty kick back from the re-valued ruble. Russian companies have to report their earning in rubles. In fact they are forced to convert 75% of their foreign currency holdings into rubles. That means if they were selling something to China for example (given the ratio of exchange rate is similar), what they were selling to China for 113 rubles in the past, they’re now getting only 85 for, so they automatically suffer a loss of 28 rubles. That’s a lot of money, which reduces their profitability and their income. Add to that material costs rising closer to 20%, labour rates rising at 11% (which is figure excluding inflation and annualized is actually 21% for 2024), and the interest rates they’re paying on loans in the region of 27% – Russian businesses in the export trade are in dire circumstances. Indeed this explains why the sector has almost been wiped out.

OIL

Exporting oil at the worst rate of 113 rubles/$1 at $65 per barrel brings in 7,300 rubles per barrel. At 85 rubles/$1 it brings in just 5,500 rubles per barrel. Just remember that Russia has created this problem for itself and its a lot harder to undo that it seems, when you’re desperately trying to get inflation down and yet you’ve short circuited your own economy. Across the whole economy income is down 25%.

This lack of income is actually creating a significant deficit in the Russian budget – and it’s down to its last $40 billion in reserves. In fact the long term outlook for a Russian collapse in early 2024 suggested late 2025-early 2026 and that seems to be on schedule.

ARMAMENTS INDUSTRY

The state continues to funnel real and ‘printed’ money into the system – constantly shoving orders for new weapons and supplies through the industries that make them. However they have largely reached peaked capacity because they simply do not have the work forces to make any more and they cannot afford (and don’t know to operate) the expensive robots and industrial machines that would make them more efficient. They just don’t have the investment funds and cannot afford them even if they are offered them, and often they are forced to take them, against their better judgment because the State wants what the State wants.

This is just building up trouble for the future. It puts the government in a position where it has little choice but to prolong the armaments buying spree even beyond the war, or risk the complete collapse of hundreds of industrial enterprises. They will not have the market or orders to just suddenly switch back to civilian manufacturing, they won’t need the labour force, the economy will dive headlong into a massive recession. Russia has trapped itself in an unsustainable scenario and the longer it goes on the worse it will get. There will be a day or reckoning eventually, and it will be painful.

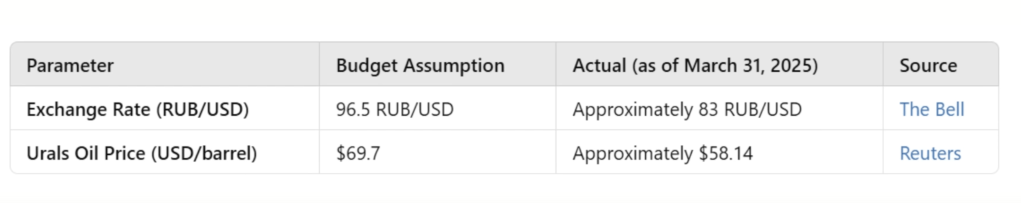

Above are the actual figures the Russian state budget was based on. As you can see the assumptions against the realities are way off.

CONCLUSION

Russia has placed itself in a position where its options have started to narrow dramatically. Its lowered income, rising costs and lack of financial reserves pace it in an increasingly perilous situation. Currency manipulation, rules designed to stabilize a floating currency that is no longer floating – the insistence business translates hard currency to rubles – no longer make sense – yet Putin doesn’t see it, as his own direct meddling in the interest rate shows.

The fiscal projections have been undermined by circumstances partially out of Russian control, but they have seriously worsened.

Russia has clearly chosen to carry on the war, it’s not interested in peace. Yet that choice is a perilous one for its economy. Its army is in a mess – we can all see it, and even if it takes ground the costs are vast for little return, in manpower and money. New tanks, new vehicles, are thin on the ground and factories cannot produce anything like what Russia needs to even replace what it loses. In fact its losses in machines are in tanks alone, around 9 lost for every 1 built. Its far worse if you look at artillery or supply trucks.

So the budget is underfunded, income is shrinking, the long term return to civilian use is way off and likely a catastrophic recession is looming. The temptation to carry on as is in a war economy is high, but it’s clearly unsustainable long term. Either way it seems, the Russian economy is in for a rough time. It may take months , maybe a year or more, but its coming and when it does its going to be very, very bad.

The Analyst

militaryanalyst.bsky.social

But then BFF China

LikeLike

Excellent article. It’s been clear for quite a long while that Russian economic collapse or something approaching it is the way this war will be resolved. The Biden administration had worked that out too, but instead of planning for it, they tried to prevent it.

Ukraine strategists have also understood it, which is why they developed the long range strike capability to target Russia’s economic lifelines, and weapons logistic chains.

War is almost always multi-dimensional – unless one side has sufficient military advantage to conquer its opponent rapidly, as Putin erroneously believed he could do with Ukraine.

OTOH, it’s unclear why Trump thinks it’s reasonable to seemingly protect Russia from the economic chaos he has visited upon the rest of the world. More so given Russian responses to his bizarre concessions. Perhaps Trump also fears Russian collapse into a nuclear armed failed state on the same flawed logic that Biden deceived himself with.

Notwithstanding the US, Putin and his cabal of psychopaths have baked into the Russian future a wide range of economic tsunamis – any of which could be catastrophic. Collapse is all but unavoidable now. e.g. Reportedly, St Petersburg hospitals are attempting to treat more than 1,000 cases of tuberculosis. Reports suggest it is rife in the Russian trenches. It spreads through the air when people with TB cough, sneeze or spit. It’s treatable with drugs, but takes many months and significant cost. This combination makes it a death sentence for any Russian soldier who contracts it, because Putin won’t want to provide expensive treatment.

I wondered why they’d manipulated the Ruble rate, so thanks for the explanation. I should have worked it out myself…the forced conversion is key. It’s a new tax on foreign currency income.

LikeLiked by 2 people

An excellent economic analyst as well…

LikeLiked by 1 person