The oil industry is one that deals in vast quantities of crude oil, a product that differs surprisingly depending on where it comes from. Few of the end products such as petrol and diesel are the result of a single type of crude, but a blend. They go by names such as ‘light sweet’ typical of oils from the North Sea labeled under the terms ‘ICE Brent Crude’. That actually stands for Intercontinental Exchange, the oils known as BFOET, come from a blend of several North Sea crude oils, including Brent Blend, Forties, Oseberg, Ekofisk, and Troll. Some argue it’s the most versatile crude on the planet that needs the least mixing and is most easily used. As a result it’s considered a benchmark price for oil globally.

As of today Wednesday Nov 19, at 15:30 that price was sitting at $62.84 per barrel. let’s call it $63 for ease. Hard to think three years ago it was nearly double that.

A single barrel of oil is 159 liters (it’s a fraction under that but not enough to matter for this exercise. For information when Urals Crude oil is discussed in tons there are 7.22 barrels (1,148 liters) per ton. Most refineries talk in tons of processed oil per year. Not all crude oil weighs the same so it varies in physical volume, hence the preference for a weight rather than a liquid volume.

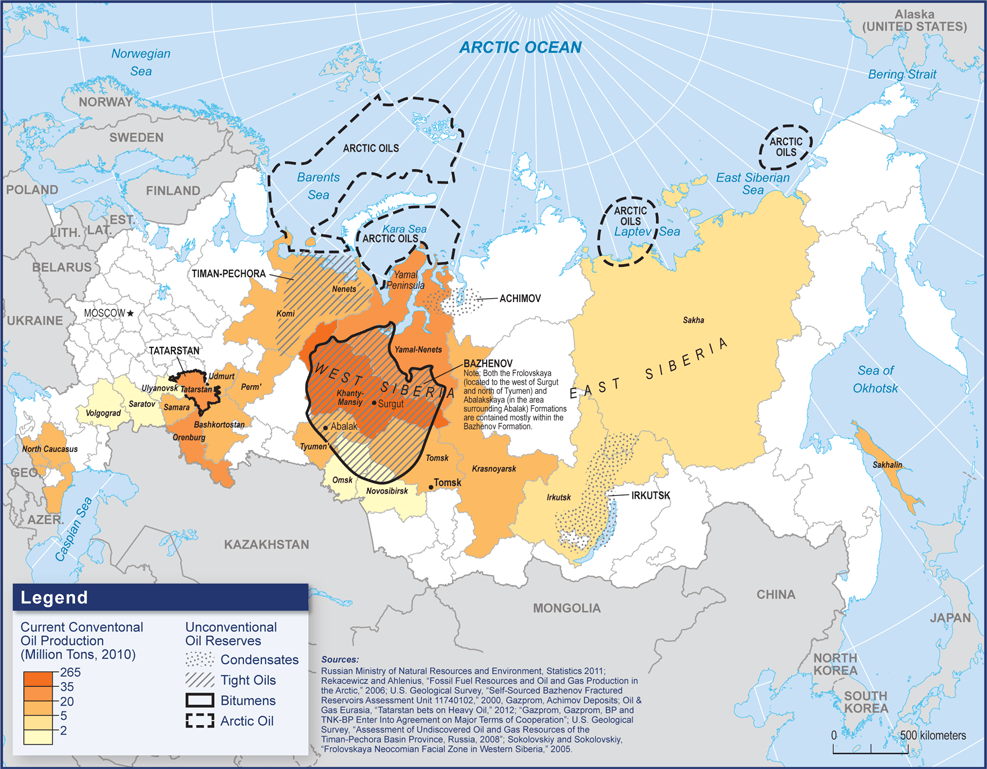

Russian Crude Oil

One of the functions of the Russian refinery system – and why there are so many of them because Russia doesn’t need over 40 refineries for just domestic use, is to mix the crude oils extracted in the oil fields, into what its defined as Urals Crude. The heavier crude oils extracted from the Urals and Volga fields is mixed with the much lighter crude oil from the West Siberian fields. Urals crude was previously pipelined to Europe but is now mostly exported by sea.

Russian Urals crude has a higher sulphur content which is one reason it’s always been cheaper than some other crude oils (except perhaps Venezuelan crude which is very high in sulphur). Sulphur causes problems in petrol and aviation fuels so the crude takes more processing, and the yields it provides in terms of avgas and quality petrol are lower.

Russian Urals is described as a ‘medium sour’. Its characteristics make it able to provide a crude that yields a balanced output of diesel, naphtha, heavy fuel oil, jet fuel, and gas oil when refined. Generally it’s a good all round crude, with low viscosity making it ideal for pushing through pipelines. Its downside is it’s not good for producing the very lightest fuels and distillates.

Russian Refineries

Russia’s refineries are some of the world’s largest and most complex. They are used as mixing facilities for incoming crude sent by pipelines direct from the oil fields, and they then convert that through full refining to finished products for domestic use and export, or the mixed crude is pumped onward to the export terminals. The European export pipelines were basically a metered system; whatever went through the buyer paid for on a daily rolling basis.

Typically the export terminals can handle separated finished product, or crude oil for onward delivery to refineries at the buyers end.

When Ukraine hits a refinery the primary target is the cracking tower – they split the oil into heavy and lighter fuels and produce finished product. Their secondary targets are the mixing plant where the crude types are brought together to create ‘Urals Crude’.

Russia’s pipeline system is very flexible and itself holds a staggering amount of crude, there are enough refineries and enough storage to allow for multiple redundancies, which is why no complete collapse has been forced. However with each new attack and with the continuous stream and scale of the attacks, the viability of the refinery system is declining. With it goes Russia’s capacity to export, but the scale of production is huge and as long as there are tankers and operating points to mix the crude to export it, the system rumbles on.

By attacking sensitive spots like the mixing and export facilities at Ust-Luga, Tuapse and Novorossiysk, Ukraine is causing the system to back up – if you can stop the refineries refining, the exports from being exported, the pipelines from pumping, then sooner or later it will reach a point where storage is maxed out, refining can’t keep up and the oil fields themselves have to be closed down. That’s the last resort – shutting them off and capping them is a nightmare of costs and getting them back on line is just as bad. Both require expert handling Russia lacks.

This ultimately, is the point where Russia drowns in a sea of its own oil. If the oil fields pump and the pipelines freeze in the Siberian winter unable to be processed, the fields will breakdown and leak – just as happened in the Soviet era where millions of hectares were permanently contaminated as the money to maintain them vanished.

Crude Exports

Russia pumps around 7.4 million barrels a day (it was over 11 million bpd in early 2022) at the moment, though that’s falling steeply. 3.4 million barrels a day goes by sea, the rest is pipelined to China, Mongolia, other dependent neighbors and other routes to Europe where some oil is still permitted – Hungary for example, and used domestically, shipments to N.Korea are also part of the deal with that country.

The most vulnerable element is the tanker oil trade. Oil is purchased typically three months in advance and can often be traded to new buyers while it’s at sea. However its never paid for until its delivered so if contracts are canceled – which is what India and China have done in the face of American secondary sanctions that come into effect on Nov 21st, then these uninsured tankers which can take 6-8 weeks to deliver from the Baltic, are left with nowhere to go. A situation that’s happening right now, as deliveries are canceled and over 200 tankers are left anchored in odd spots around the world waiting for a buyer.

That quickly becomes a problem, because oil export management will tell you that knowing when a tanker gets back to reload is all part of managing the supply to the export terminals. If they don’t come back, the system again, is faced with backing up.

The damage Ukraine is inflicting on export terminals also causes problems for the ultimate buyer who contracted for the oil. Russia can look unreliable if its tankers don’t depart for their destinations and arrive on a given day – a large tanker can take a day to load and another to unload, which means the refinery has to be ready and operating – continuity is king, so late or out of phase arrivals are a big deal and very disruptive.

Right now, between Ukrainian ‘kinetic sanctions’ and international sanctions the system is getting ever more constrained and struggling to cope and manage the situation. It doesn’t help that some of the big oil majors like Lukoil are in a financial mess and oil refinery workers and pipeline operators haven’t been paid in a couple of months.

Russian Oil Income

Costs

Production cost of land based Urals Crude is around $15pb

Typical tanker costs around $5pb with an extra $10 per barrel for grey tankers (the vast majority). These can get far higher if the tankers are forced to sit idle carrying unsold crude, and rapidly digs in to profit margins.

Overall grey tanker export cost per barrel is around $30.

The official price of 1 barrel of Urals Crude is around $62, but nobody is paying that or anywhere like it. Current spot price for Urals Crude on the discounted market Russia is actually selling at, is around $36.61 if purchased at Novorossiysk for immediate tanker export.

Typical discount against ICE Brent Crude is now $23.50pb at Russian ports – up from between $10-13pb in the past weeks.

Margins

So Russia is making around $6.61 per barrel at the moment, call it $7 for ease.

3.4 million x 7 per day is $23,800,000.

$714,000,000 per month, or $260.61 billion per year. That is a stunningly vast drop from recent years – over $400 billion a year less.

This is a country that is dependent now for around 40% of its entire state income on oil exports – and this is just the decline in sea based exports. Remember that Russia’s pre-war economy was around the size of Canada’s or Italy’s – it wasn’t that vast in the first place given its population and size. Without oil it would be an economic minnow. Imagine your country’s finance minister turning round and saying to parliament, “We have a bit of a problem, $400 billion has gone missing from the accounts this year and there’s nowhere to make it up from”. In the middle of a war that’s costing $200 billion a year at the absolute minimum. So you haven’t just lost the $400 billion you’re still spending $200 billion out of what you have left.

You based the 2026 budget on getting $70pb, and you’re getting half of that. And you have no idea when or where these sanctions will end, and more are coming. Add to that the horrendous military pressure from Ukraine on the energy sector, there’s a real possibility it could be shut down. If pipelined exports decline in volume as well – and they are, along with prices, how can you possibly keep this war going?

The long term forecast for the oil industry is that peak oil will be in 2030, after that renewables and electrification of vehicles starts to swing the balance the other way. Longer term, oil is in decline. Everyone knows that, including Russia. That’s why they’ve been pumping it and selling it while it has value, because Russia doesn’t actually have especially vast reserves. Its easy to get at and pump geologically but the fact is they’re pumping what they have as quickly as they can before it loses value in the decades to come.

Short-medium term, OPEC+ has increased production above market demand by as much as 4% – and that’s hammering prices. The Saudis and the Americans know what they’re doing – its driving cheap Russian oil out of the market and substituting it with US, Saudi, Brazilian and Argentine – all countries desperate to expand market share and make money while they can – even if Russia suffers, because they really don’t care if they do, Russia means nothing but trouble to them, whatever the face they put on it.

Russia has been given opportunity after opportunity to get out of this war. Trump offered incentive after incentive and is about to again. If Putin doesn’t see this one and carries on with his maximalist approach, Trump and the US administration will see it as a slap in the face and leave Putin to rot. In the mind of the Americans he will deserve it, they tried to help him help himself, he rejects it, they give Ukraine whatever it needs if it buys it (or Europe does).

Ukraine has the keys of victory almost in its grasp. Another failed Trump peace process offer is now on the table – although the Russians say they don’t know anything about it, their continued kinetic sanctions against Russia’s oil industry – which is effectively its lifeblood – added to hitting military industry and power generation, will bring Russia to the point of collapse. I give it six months to a year. I think this will be over before the end of 2026, one way or another.

The oil export values and the income problem Russia faces are gigantic – insurmountable obstacles that are like the ball in an Indiana Jones movie, only you can’t get out of the way. The bankers in Russia see it coming, I suspect the oligarchs do too, and many others. What they don’t know is how to stop it – or even if they can.

The fact is the world can actually live without Russian oil – something that five years ago would have been seen as impossible. Ukraine lasting four years was seen as impossible – most thought they wouldn’t last four days. Things change. The unexpected happens, nobody planned for any of this. Least of all Vladimir Putin, whose strategic genius I think we can all say now, was as fake as the Russian militaries preparedness.

Winners

Every cloud has a silver lining. The United States and Saudi Arabia are the big winners in this new sanctions war on Russia. The US is a cynical nation driven by avarice under its current regime. It may sit there teasing Russia about its failure to win the war as if it was a good thing they did, while nagging Ukraine into an act of self immolation. Yet its the American LNG producers who are making huge profits exporting to Ukraine and Europe – the latest deal with Greece Zelensky just signed is to pipeline US LNG to Ukraine using the same pipelines Russian gas is using to reach Serbia and Hungary via Turkey.

Saudi Arabia gets to reclaim its lost customers from the Russians (and at the end of the day the Saudis really don’t like Russia for many good reasons), and they know they’re better off in America’s bed.

And Ukraine of course, can become a winner. If it can stop Russian exports.

In case there was any doubt about the mess Russia’s finances are in, in the past day the Russian Central Bank has been pumping in 2.83 trillion rubles to the banks who promptly used 150 billion of it to buy Central Bank bonds. They know why inflation is unsustainably high, it’s because they keep ‘printing’ money. They keep printing money to make ends meet, and because they need the inflation to drive the value of debt down long term. The only foreign currency they have is now Chinese Yuan, and they can’t find enough to spend it on. Now they have to hoard even that because China isn’t buying oil on the scale it was.

Ukraine is driving the oil industry into the ground and must keep doing so. Domestic shortages are vital to disrupt Russia generally and bring the war home. The refineries are key to that and depriving the military of fuel. It also affects the chemicals industry from explosives to rocket fuel. And it makes fertilizers more expensive and pushes Russian food prices higher.

It’s cutting the exports that will ultimately end this. It’s real money they’re being denied and all the fiscal trickery in the world can’t keep the war going without real income.

The Analyst

militaryanalyst@bsky.social

errors and omissions accepted

Thank you TA for writing such a superbly optimistic and clearly accurate account of Putin’s Russia today. Again you have shown why Ukraine should never give in to the demands of Trump or Putin as they are definitely on the road to a decisive victory over Russia. Very soon the world will be a much safer place to live in.

LikeLike

Thank you T/A. Always informative.

LikeLiked by 1 person

I think Russian collapse is now unavoidable. Even if Ukraine signed Trumps surrender deal, which they obviously won’t , but hypothetically speaking if they did Russia would still collapse.

LikeLike

Excellent synopsis of the oil market; and the Zugzwang Putin has played Russia into. Russia is staring down the barrel of military defeat and economic disaster. Six to twelve months is as good a prediction as any, but the likelihood of avoiding it altogether seems remote.

However, Trump now wants to give Putin a “Get out of jail free” card in the form of the latest 28 point capitulation plan that the Americans are trying to bully Ukraine and the Europeans into accepting. Reuters has reported that the US is threatening to block intel sharing and weapons shipments if Ukraine won’t capitulate. It is beyond abhorrent.

LikeLike

USA threatens to withdraw intelligence from Ukraine. It time to tell USA publicly that if they do we will close down NATO. We cannot have an alliance with a country that has no moral compass.

LikeLike